Retail Credits API Services and Integrations

The technical flow diagram and request/response information provided below are applicable to both shopping credits tied to the cart and cash credits within the wallet. Whether the process will involve shopping credits or wallet credits is determined based on the request information passed to the respective methods.

.drawio.png)

GetCreditPaymentPlanSimulation

It is used to calculate the estimated payment plan before the flow is initiated. (simulation) It is not mandatory to call. It is used as needed. It can be used independently of the flow.

Request Parameters:

OrderItems ve CategoryId fields are mandatory in the cart structure. They are not mandatory in wallet structures

The TotalAmount value sent in the cart structure must be equal to the sum of the Amount values sent in the OrderItems field, otherwise an error will be received.

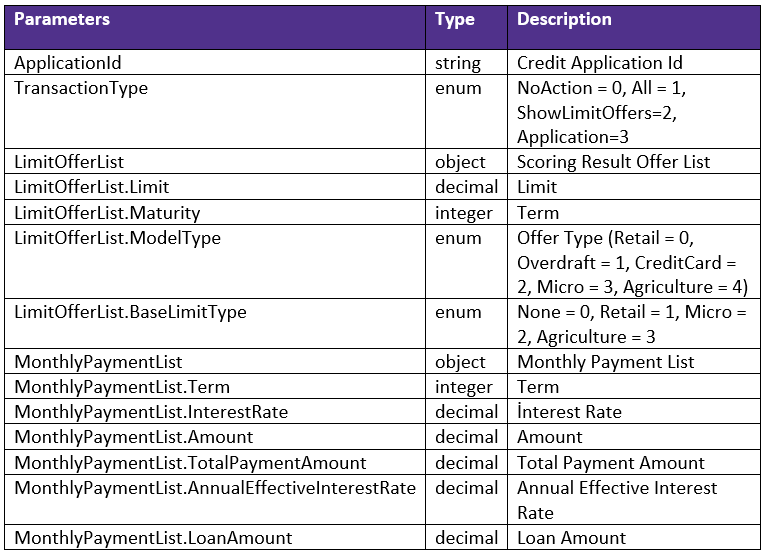

Response Parameters:

StartCredit

The method that initiates the flow. It is not mandatory to call. If the method is not called, the flow initiation process is done with the CheckLimitAvailability method

How It Works:

The TCKN information, date of birth, phone number of the person who will use the credit, and the reference (guid) information that the client will determine throughout the flow are collected. This information is checked against the KPS in the visited method and if it is appropriate, ApplicationId is returned

The ApplicationId which is returned from the response is used throughout the credit process, and the flow proceeds through this ID.

If IsOtpSend field is true, the flow continues with the VerifyShoppingCreditOtp method.

Request Parameters:

Response Parameters:

VerifyCreditOtp

It is not mandatory to call within the flow. It is called if the IsOtpSend field in the response of the StartCredit method is true. If OTP verification is mandatory, the customer is provided with the information to verify OTP in the Start method and the verification is provided with this method

Request Parameters:

Response Parameters:

GetCreditLimitOffersRequirement

If the Super Limit structure will be used, it is mandatory to call this method in the flow, it is not mandatory in other cases.

Request Parameters:

Response Parameters:

GetLimitOffers

It returns the super limit scoring result information according to the customer's response to the questions sent with GetCreditLimitOffersRequirement method. It is mandatory to call this method if the super limit structure will be used, otherwise it is not.

Request Parameters:

Response Parameters:

CheckCreditLimitAvailability

The method returns the customer's credit limit and payment plan based on their shopping cart for shopping credits or their personal information for wallet credits. This is the method used for Score Limit transactions and it is mandatory to call it

Notes:

If the shopping cart structure is active, it is mandatory to send the OrderId and OrderItems fields

If the super limit structure is active and the LimitOffers method has not been called before, it is mandatory to send the WorkingStatus, WorkingTitle, and MonthlyIncome parameters

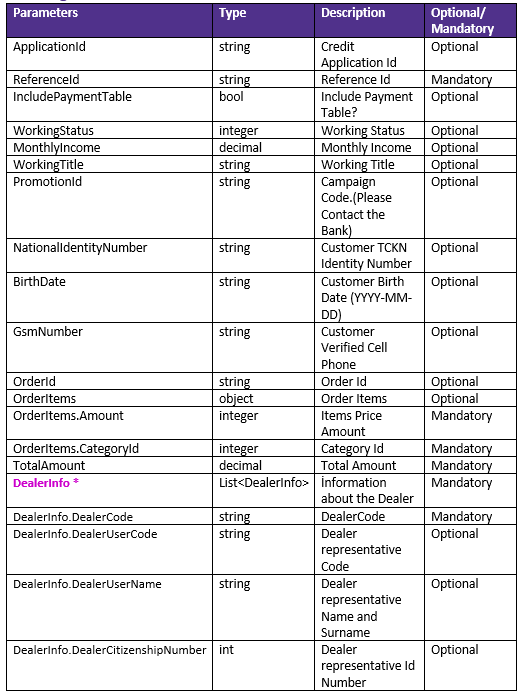

Request Parameters:

* It is expected that the DealerCode field in the DealerInfo list will be filled after agreeing with the bank and having the dealer definitions made.

In order to have the dealer definitions made, the following information must be provided to the bank for the relevant dealers when the dealer list is sent: commercial name, Denizbank account information, dealer email address, and other dealer information. Other fields in DealerInfo are not mandatory

Response Parameters:

GetCreditPaymentPlanInfo

Provides detailed information about the payment plan, such as the amount of each installment, the due dates, and the interest rate, when needed.

Request Parameters:

Response Parameters:

ApplyCredit

This method is mandatory and allows for the creation of a credit application. The CallbackUrl value in the Request information specifies the URL to which the user will be redirected after the application is submitted, and the TimeToLive information specifies the amount of time within which the process must be completed.

Request Parameters:

Response Parameters:

GetCreditApplication

This method allows you to retrieve information about a submitted credit application. It can be called at any time.

Request Parameters:

Response Parameters:

GetCreditApplication Response - AplicationStatus Error Codes:

NotFound = 0,

InProgress = 1,

Canceled = 2,

Rejected = 3,

InFraud = 4,

Used = 5,

Mvg = 6,

DocumentControl = 7,

SendDigitalApproval = 8,

Allocation = 9,

DocumentConfirmation = 10,

Dob = 11,

DobCourier = 13,

Courier = 15,

CourierOperations = 16,

ReadyCreditUsage = 17,

EcommerceSendDeepLink = 18,

PreStart = 19,

StartCreditApplication = 100,

SingleScoringRequirements = 101,

SingleScoring = 102,

AvailableCreditProducts = 103,

CreditProductDetail = 104,

CustomerCreditRisk = 105,

SaveClosureCredits = 106,

ExternalCardCollectionOperation = 107,

CalculatePaymentTable = 108,

RecalculatePaymnetTable = 109,

EvaluateCredit = 110,

InsuranceRequirements = 111,

EvaluateInsurance = 112,

CreditCardRequirements = 113,

SendOtpSms = 114,

VerifyOtpSms = 115,

CustomerCommunicationPoint = 116,

CreditDetailInfoRequirements = 117,

EvaluateCreditDetailInfo = 118,

DoCourierOperation = 119,

ProceedCreditApplication = 120,

AvailableInsuranceCrossSaleProduct = 121,

EvaluateInsuranceCrossSaleProduct = 122,

AvailableKmhInsurance = 123,

GenerateDocument = 124,

ApproveDocuments = 125,

ApproveDigitalApproval = 126,

DoCreditUsage = 127,

ProcessCancelled = 200,

NewDocumentConfirmationProcess = 201,

NewDigitalApprovalProcess = 202,

ProcessExpired = 203,

NewApplicationProcess = 204,

ReadyCreditLimitIsGreaterThanReadyLimit = 206,

ReadyCreditExpired = 207,

NeedCustomerCommunication = 208,

ReadyCreditLimitIsGreaterThanPreApprovedLimit = 209,

ThereIsNoLimit = 210,

BatchApplicationStatusUpdateToCancel = 211,

DobCourierError = 400,

CourierError = 401,

DobError = 402,

DepositAccountError = 403,

ProcessUsageError = 404,

ProceedProcessError = 405,

EngagementDateExpiredError = 406,

OtpResendMaxTryCountError = 500,

OtpVerificationMaxTryCountError = 501,

ScoreReject = 502,

ScoreGrey = 503,

ScoreRequestNotAccepted = 504,

CourierReject = 505,

CourierAppointmentFailed = 506,

CourierHasNoAvailableDate = 507,

ScoreHasNoSuitableLimit = 508,

ScoreHasNoLimit = 509,

RecurrentApplicationScoreRejected = 510,

CourierCompletedUnsuccessfully = 511,

CustomerFailResult = 512

Note: ApplicationStatus values may vary as development progresses.

RefundCredit

Allows for the partial or full refund of a loan. The Credit process is expected to be completed before the cancellation. If the process is not in the Finish status and the method is called, an error will occur.